Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

November 1, 2024

Stay up to date with our monthly market commentary:

The price of Bitcoin (BTC) increased by 13.2% in October, ending the month at $72,500.

October, or “Uptober,” as it’s better known within the Bitcoin community, was off to a slow start. In the first week of October, the price of Bitcoin (BTC) dropped by 5% but quickly recovered and ended the month close to a new all-time high at around $72,500.

This price increase was also visible with the spot Bitcoin ETFs, which saw four out of five net positive inflow weeks in October. Two out of those four weeks even saw net inflows of over $2.13 billion and $2.24 billion, respectively.

Since MicroStrategy announced its Bitcoin strategy, other public companies have followed suit and are also buying BTC for their balance sheets.

We at Samara Asset Group are a prime example of that! This month, we announced that we’re issuing a €30 million Nordic Bond to use the proceeds to acquire additional limited partnership stakes in alternative investment funds and increase our Bitcoin holdings on our balance sheet.

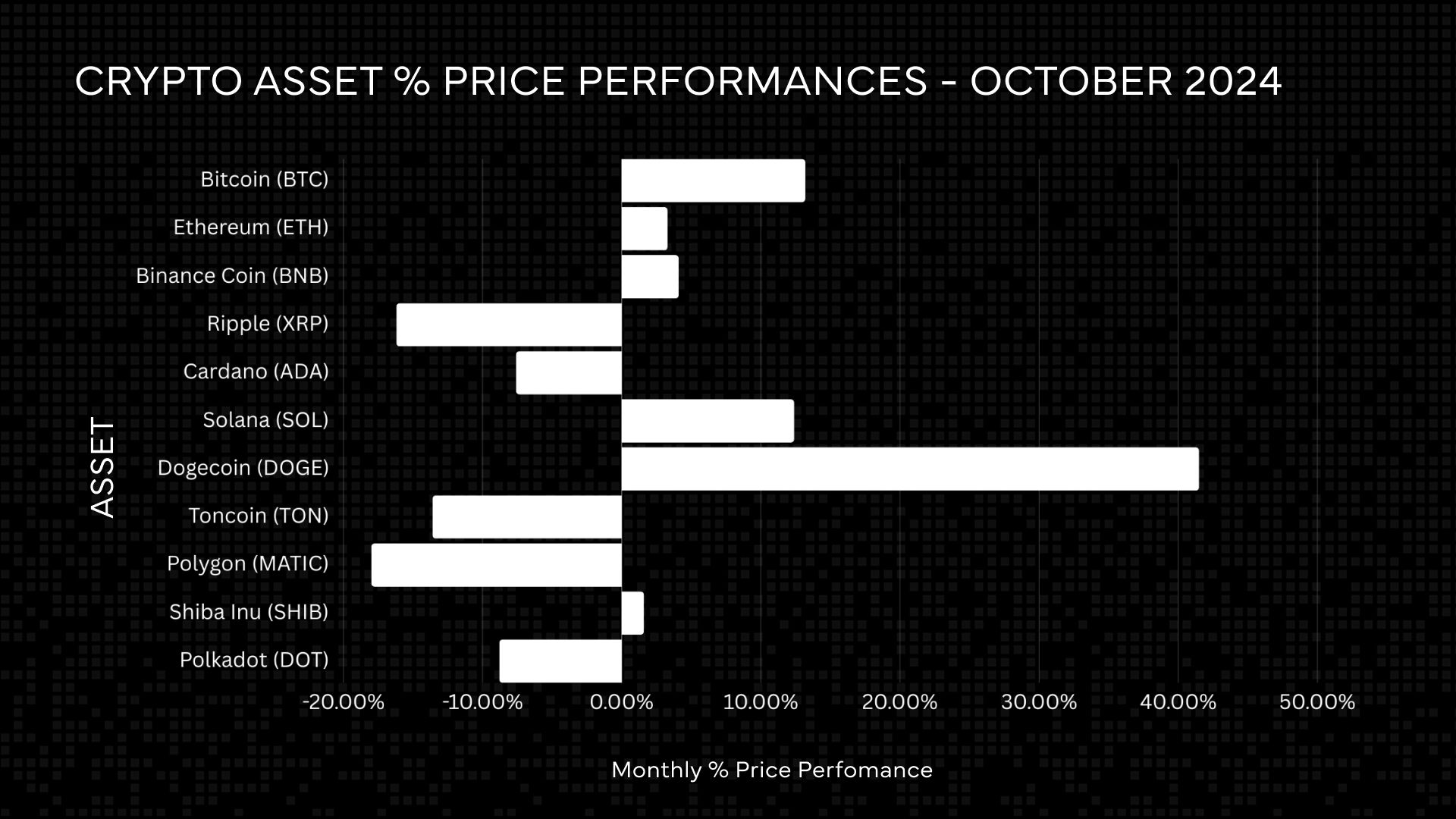

The crypto asset markets finished the month a leg higher, with some of the top ten assets by market capitalization rallying by more than 5%.

Historically, October has been a good month for the price of Bitcoin (BTC). This year, it also held to this promise by finishing the month up 13.2%, edging closer to a new all-time high with a monthly close of $72,500 ahead of the U.S. elections.

In addition to Bitcoin, Ether also rallied, finishing the month 3.3% higher. This increase is due to the overall rise in liquidity, announcements of new upgrades to the protocol, and positive market sentiment for digital assets. The spot Ether ETFs saw a neutral month, with two outflow and two inflow weeks.

Next to Bitcoin, the largest gainers this month were the two leading altcoins, Dogecoin (DOGE) and Solana (SOL), which closed the month 41.5% and 12.4% higher, respectively. Dogecoin was boosted by Elon Musk’s comment about DOGE during a town hall meeting. Concurrently, Solana’s price has benefitted from the renewed interest in memecoins.

The remainder of the top crypto assets market had a mixed month. While some of the most popular coins finished the month in the green, others saw some price corrections.

Bitcoin Layer 2s continue to make waves, with Bitcoin scaling solutions offering new developments.

The Lightning Network, the most prominent scaling solution, is fast and significantly cheaper than regular on-chain transactions, making it ideal for enabling real-time payments in everyday situations.

However, having a fully functioning Lightning wallet is technically challenging, and managing liquidity and node connections on mobile phones is resource-intensive. This is where Trampoline payments come into play.

These payments outsource the pathfinding in the network to a third party. With that, mobile wallets and developers can offer a much simpler and faster experience resembling payment solutions such as Apple or Google Pay.

Going forward, developers can offer Lightning Trampoline payments, potentially bringing Bitcoin to even more users worldwide and driving mass adoption.

October was an eventful month for institutional investors, with the SEC approving options on spot Bitcoin ETFs and Samara Asset Group announcing the issuance of a €30 million Nordic bond to buy (more) Bitcoin for our balance sheet.

The U.S. Securities and Exchange Commission (SEC) approved options trading for spot Bitcoin ETF issuers on the Nasdaq, NYSE, and CBOE.

With this approval, ETF issuers can now broaden the Bitcoin investment opportunities for ETF investors. The various stock exchanges where the Bitcoin ETFs are traded will now be able to list said options, and it’s up to the issuers to decide when to offer their options products.

In its NSYE approval, the SEC stated that it believes options on top of spot Bitcoin ETFs will be a great resource for investors to hedge their positions. They will allow for more liquidity with better price efficiency, which should lead to less volatility with the underlying funds.

At the beginning of October, we proudly announced that we’ve mandated Pareto Securities to arrange a series of fixed-income investor meetings to issue a €30 million Nordic Bond.

The proceeds from the Bond are intended to expand Samara’s investment portfolio by acquiring additional limited partnership stakes in alternative investment funds and increasing our position in Bitcoin, which we use as its primary treasury reserve asset.

Currently, we hold 421 BTC on our balance sheet, but the goal is to get to 1,000 BTC within a year.

According to Samara CEO Patrick Lowry, “The proceeds will allow Samara to further expand and solidify its already robust balance sheet as we diversify into new emerging technologies through new fund investments. With Bitcoin as our primary treasury reserve asset, we also enhance our liquidity position with bond proceeds.”

MicroStrategy’s Michael Saylor announced a $42 billion capital plan that includes a $21 billion ATM equity offering with which the company will acquire more Bitcoin over the next three years. Currently, the technology company holds 252,220 BTC on its balance sheet.

Metaplanet, a publicly traded Japanese company, announced an additional purchase of 156.783 BTC, bringing the Bitcoin on the technology company’s balance sheet to 1,018.17 BTC.

Metaplanet’s continuous buying of Bitcoin as a treasury asset highlights the digital currency’s use case as a cash reserve alternative for corporate treasuries.

Samara Asset Group announced a planned bond issuance with the intention to use some of the proceeds to purchase more Bitcoin, adding to the 421 BTC currently held on the company’s balance sheet.

*Closing price data is from October 30, 2024 at 16:30 CET