Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

January 22, 2024

Yet another on-chain token standard has emerged on Bitcoin, opening the network to more use cases while promising to make asset issuance more efficient.

In this guide, you will discover CBRC-20 tokens and their benefits.

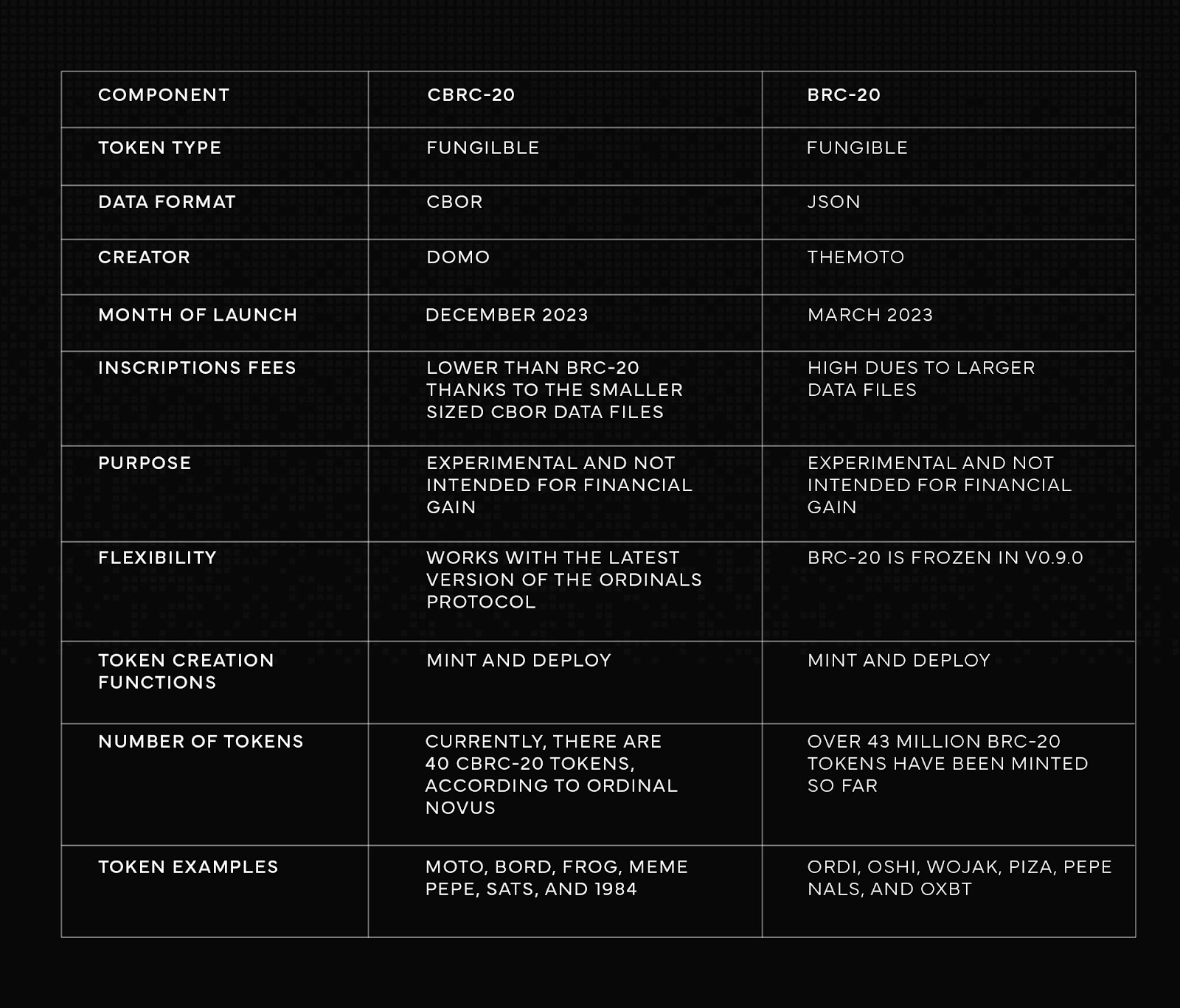

CBRC-20, also known as Cy[bord], is a new experimental metaprotocol standard for issuing fungible digital assets on Bitcoin using the Ordinals protocol.

It uses the same functions as the BRC-20 standard to create and transfer tokens. However, CBRC-20 strives to solve the inefficiencies of its predecessor by minimizing the cost of each inscription and simplifying the indexing process. These improvements have been made possible by Ord v0.10.0, an updated version of the Ordinals protocol released in October 2023.

The update introduces a game-changing metaprotocol field that enables the Ord software to officially recognize metaprotocols. As a result, projects can add metadata to the Ordinal envelope (an element of the Ordinal protocol that allows users to inscribe data to an individual satoshi).

The team behind the BRC-20 token standard has decided to “freeze” the token standard at v0.9.0. As such, it will not recognize updates in v0.10.0 and will, therefore, not benefit from the metadata feature.

A metaprotocol is a term that describes a protocol formalized via the off-chain indexing of on-chain data. In the world of Ordinals, indexing is the process through which on-chain inscription data is tracked, retrieved, and recorded on an off-chain platform by an indexer.

Tracking and updating this information is essential as the Ordinals market would otherwise not exist without someone to interpret on-chain inscription data, which is recorded in JSON text files.

CBRC-20 was launched in December 2023 by THEMOTO, a coalition of individuals that split from the OSHI team to build a new token standard. OSHI is a BRC-20 token project aiming to bring DeFi to Bitcoin.

The CBRC-20 token standard follows the same rules used to create and transfer BRC-20 tokens. These rules include four-character ticker names. The first is first principle, describing the mint limit, and a default token decimal precision of 18. This means that the maximum divisible value is 18.

Furthermore, CBRC-20 uses the same functions as BRC-20, maintaining the deploy, mint, and transfer functions. However, metadata is only added at the deployment stage.

Metadata is the arbitrary information inscribed on a satoshi. It includes the maximum token supply, the token mint limit, the ticker name, and the decimal precision. It is recorded in the CBOR format instead of JSON.

Since this data is described directly in the Ordinal envelope, there is no need to also specify it in the mint and transfer stages, as is with BRC-20. As a result, the CBRC-20 token standard minimizes the cost of minting and transferring inscriptions.

CBOR, or Concise Binary Object Representation, is a data format similar to JSON (JavaScript Object Notation). However, CBOR data is 60-70% smaller than JSON and is binary-based, consisting of 1s and 0s, instead of text-based, which is human-readable. Therefore, this data format is more efficient as it requires less storage space.

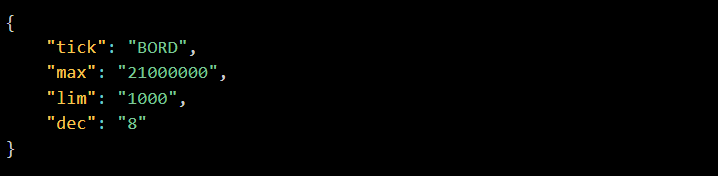

When deploying a CBRC-20 token, metadata is first inscribed in JSON and then converted to CBOR using the Cy[bord] converter.

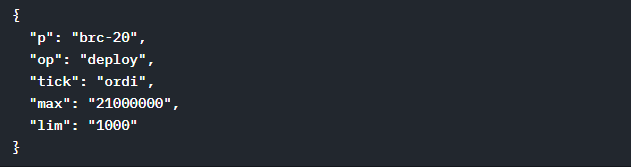

Here’s a comparison between a CBRC-20 and BRC-20 deploy function (both are in JSON format).

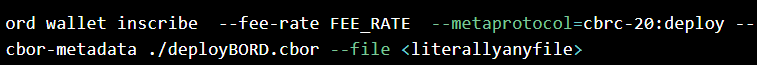

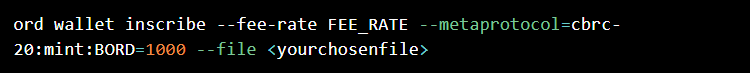

Once the file above is converted to CBOR, the token “BORD” is deployed using this command:

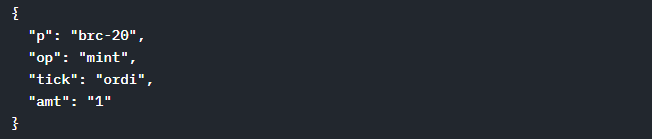

Let’s look at the mint functions.

As you can see from the examples above, the CBRC-20 token standard doesn’t specify the metadata when minting. On the other hand, the BRC-20 mint function describes the ticker name and protocol, just like the deploy function.

CBRC-20 tokens have the following benefits and drawbacks.

The launch of the Ordinals protocol in January 2023 ushered in a new era of token standards in Bitcoin. While these standards haven’t been added through the BIP process and are experimental, they have significantly affected the Bitcoin network both favorably and unfavorably.

The hype around these standards has resulted in network congestion and high fees, benefiting miners greatly. Data shows that miners’ revenue rose by 60% in Q4/2023 to $2.5 billion due to activity from Ordinals. So, while high fees are a burden for users and a potential barrier to adoption, miners remain highly incentivized to keep securing the Bitcoin network.

Nevertheless, active Bitcoin users can still use Bitcoin layers like Lightning to access low-cost transactions. Based on this perspective, the current high transaction costs on the main chain could be the feature that substantially promotes the adoption of Bitcoin Layer-2 protocols.

You can buy CBRC-20 tokens on Ordinal Novus, the first marketplace for these assets. To purchase a CBRC-20 token, open the Ordinal Novus website and connect your Xverse or Leather wallet. Next, explore the tokens listed for sale and click “Buy Now” to acquire your asset of choice. Ordinal Novus advises buyers to purchase tokens with a green checkmark.

You can buy CBRC-20 tokens on Ordinal Novus and SatsX. Ordinal Novus lets users purchase various CBRC-20 tokens using a Leather or Xverse wallet. On the other hand, SatsX lists many CBRC-20 tokens and supports Bitget, Unisat, Xverse, and Wizz wallets.

Both marketplaces have clean, easy-to-use interfaces. They also provide crucial data like trading volumes and current transaction fees in the form of satoshis per vByte (sat/vB).

You can mint CBRC-20 tokens on SatsX in a few easy steps. Open the platform’s website in your browser and select the Cy[bord] protocol on the left. Subsequently, connect your wallet and then go to the “inscribe” tab. Type a four-character ticker name for your token and click “Preview.” Lastly, choose the transaction fees you wish to pay and hit “Inscribe.”

Yes, CBRC-20 tokens are risky. They are experimental and not intended to be traded for financial gain. Since the price action of CBRC-20 tokens is presently driven by investor speculation and user experimentation, price volatility can be significant. If you decide to buy a CBRC-20 token anyway, do your due diligence first and never invest more than you can afford to lose.