Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

May 2, 2024

Powered by blockchain technology, security tokens have emerged as a digital alternative for investing in traditional asset classes such as stocks, bonds, and even real estate.

In this guide, we will look into what these security tokens are in crypto, how they work, their benefits and drawbacks, and how they differ from utility tokens.

Crypto security tokens are digital assets traded on the blockchain that derive value from real-world assets. In the US, these tokens are governed by federal securities regulations.

Security tokens represent ownership in real physical assets, companies, or entitlement to interest payments, functioning similarly to bonds, stocks, and derivatives. Projects that comply can leverage security tokens for various purposes.

A security token is created through a tokenization process.

Tokenization involves converting asset ownership rights into tradable tokens, which creates blockchain-based financial assets. These assets can include equity, debt, and investment funds, allowing for fractional ownership and easy market access.

Besides financial products, security tokens can represent ownership in assets like real estate and fine art, expanding market liquidity and access. The blockchain records all token trades and ownership, eliminating third-party recordkeepers and increasing transparency.

In the case when security tokens represent shares in a company, they work like investment instruments, providing equity token holders with dividends when the issuing company earns and distributes profits to its shareholders.

In the US, security tokens have to meet the criteria of the Howey Test to be categorized as securities and are thus subject to federal securities regulations.

Security tokens operate on blockchain-powered networks, such as Ethereum. Smart contracts, encoded with predefined rules on the blockchain, facilitate the issuance and management of security tokens. These self-executing contracts help ensure compliance with regulatory requirements and automate various processes, including dividend distribution and voting rights.

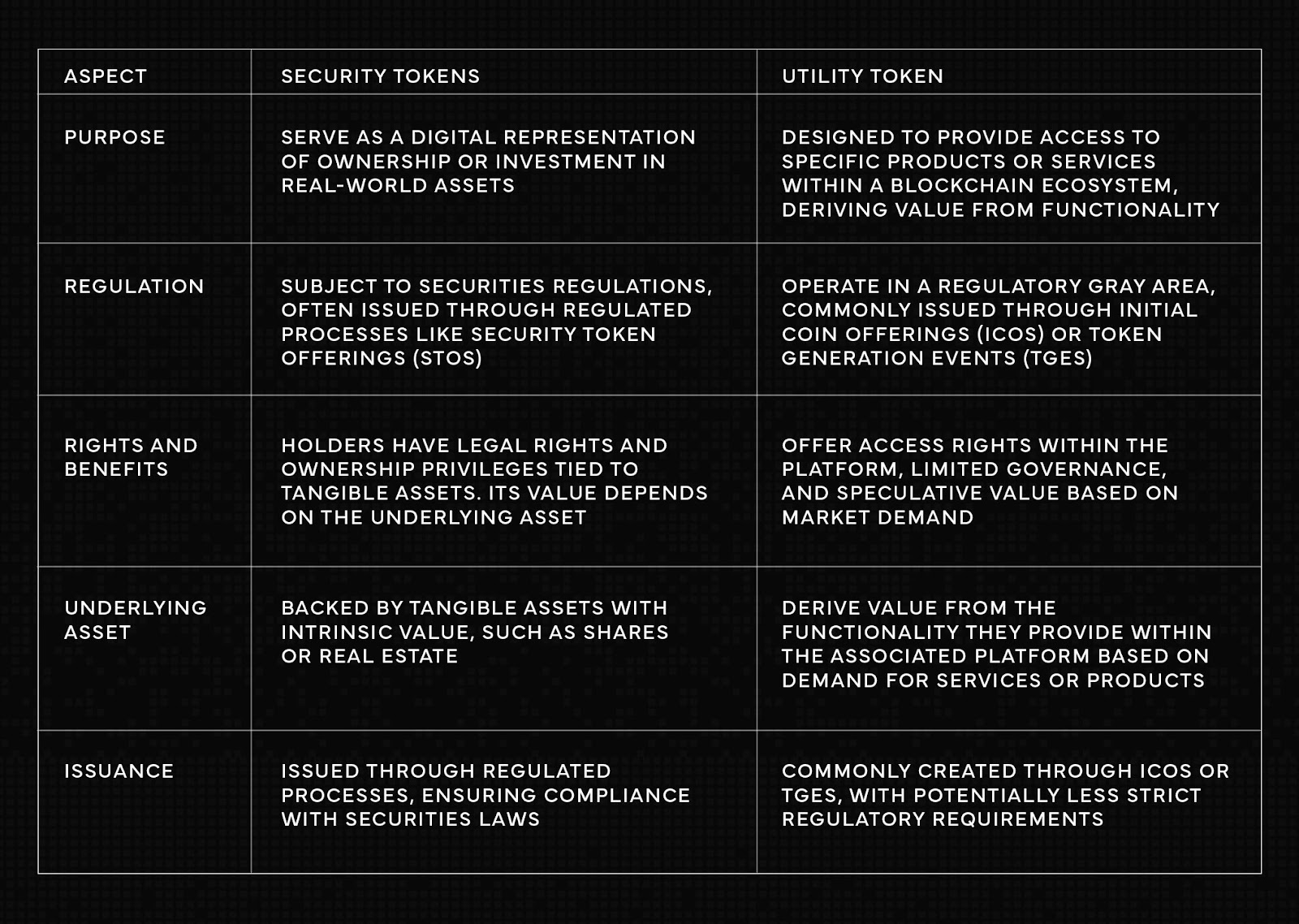

While security tokens and utility tokens are different, they still have some similarities:

While security tokens have several advantages, they still have drawbacks. Below, we explore these benefits and drawbacks.

Tokenized securities could revolutionize traditional transaction methods across various asset classes, potentially making them more accessible to a broader investor base.

According to Boston Consulting Group and ADDX, asset tokenization is projected to reach $16 trillion by 2030, 10% of the global GDP. Other research conducted by the Frankfurt School of Finance and Management, PlutoNeo, and Tangany in 2021 forecasted that Europe will experience a surge in Security Token Offerings (STOs) over the next five years, with a market value of over €918 billion by 2026.

The future of security tokenization appears promising, with increased adoption and acknowledgment from the financial sector. As more traditional assets undergo tokenization, the benefits, such as enhanced efficiency, reduced costs, and improved accessibility, become increasingly evident.

However, for this shift to occur, collaboration among investors, regulators, and industry stakeholders is essential to establishing the regulatory frameworks and standards.

An example of a security token is Blockchain Capital (BCAP). Launched in 2017 as the first security token in the market, BCAP is a digital token built on Ethereum representing ownership in a venture capital fund.

Yes, they are legal. Security tokens are subject to securities law and must be registered as such, as they represent ownership in underlying assets, just like bonds or stocks, meaning they are overseen by regulatory bodies such as the U.S. Securities and Exchange Commission (SEC).

A Security Token Offering (STO) is a fundraising method where security tokens are issued and sold. It is a type of public offering in which companies issue and sell security tokens representing ownership or investment rights in real-world assets to raise capital. STOs can be viewed as the digital version of an Initial Public Offering (IPO).

A token is a general term for various digital units on the blockchain. They derive their value from utility within the platform or network they are part of. On the other hand, a security token is a token that represents ownership or investment rights in a real-world asset such as intellectual property, real estate, or company. It derives value from the underlying asset it represents.