Bitcoin

Bitcoin CPI

Venture Portfolio

Funds

Market Insights

Indicators

About

Contact

November 17, 2024

Bitcoin bridges provide Bitcoin users with the ability to deploy the digital currency in other blockchain ecosystems.

Read on to learn more about Bitcoin bridges, including how they work and what risks you should be aware of when using them.

Blockchain interoperability is the ability for different blockchain networks to communicate, share information, and interact with one another. This means that a transaction could start on one blockchain and end on another, or data can be seamlessly transferred from one blockchain to another.

The purpose of interoperability is to overcome the limitations of current blockchains operating in silos, each with its own protocols, rules, and communities. Interoperability allows for the creation of more complex systems that leverage the unique strengths of different blockchains.

For example, a smart contract on the Ethereum blockchain might trigger a transaction on the Bitcoin blockchain, or a decentralized application (dApp) could use data from multiple blockchains simultaneously.

A Bitcoin bridge is a cross-chain bridge that allows the transfer of Bitcoin from the Bitcoin blockchain to another blockchain in tokenized form, enabling blockchain interoperability for Bitcoin users.

Blockchains and their native assets are typically locked in as independent ecosystems and can't communicate with other chains without a cross-chain bridge. Blockchain bridges allow blockchain interoperability by facilitating flexible token transfer through different chains.

For instance, a cross-chain bridge makes it possible to deploy Bitcoin (BTC) in the DeFI ecosystem on Ethereum. The cross-chain bridge acts as a bridge (hence the name) between the two chains and transfers your digital assets from one ecosystem to another.

However, instead of then holding native BTC, you hold a tokenized version of BTC on the new chain, 1:1 redeemable for native BTC.

The process typically begins with the original asset being locked in its native blockchain, often secured by a smart contract or a multi-signature wallet.

Once this asset is locked, an equivalent amount of a wrapped or pegged token is minted on the destination blockchain, representing and backed 1:1 by the original asset. This enables the locked asset to interact with the new blockchain environment while maintaining its intrinsic value.

For instance, Bitcoin could be locked on its native blockchain, and an equivalent amount of Wrapped Bitcoin (WBTC) could be minted on the Ethereum network, allowing Bitcoin to be utilized within Ethereum's DeFi ecosystem.

If users decide to retrieve their original asset, the process is reversed: the wrapped token is burned or destroyed on the secondary blockchain, and the corresponding amount of the original asset is unlocked and returned to the user on the native blockchain.

There are two main ways cross-chain bridges transfer digital assets: the wrapped assets method and the liquidity pool method.

This blockchain bridge method uses smart contracts and wrapped tokens. The bridge doesn't actually move assets but locks the assets you transfer in a smart contract.

The smart contract mints and gives you equivalent wrapped tokens on the new network. Wrapped tokens are creations of the smart contract that represent your cryptocurrency but are compatible with the other blockchain.

For instance, if you want to transfer BTC from the Bitcoin network to Ethereum, a Bitcoin bridge will hold your BTC in a smart contract that then mints Wrapped BTC on Ethereum.

This method is usually centralized and requires liquidity pools with a variety of assets. A centralized liquidity provider manages the pools.

For instance, if you want to bridge renBTC from Ethereum to BTC on Bitcoin, the liquidity provider will send you an equivalent amount of BTC after your renBTC pool deposit. The centralized authority uses the pool assets to complete transactions and charges a small fee.

However, liquidity pools only work if users lock their assets in the pool and actively keep trading. Most bridges with liquidity pools have staking programs with rewards to encourage users to lock in their assets.

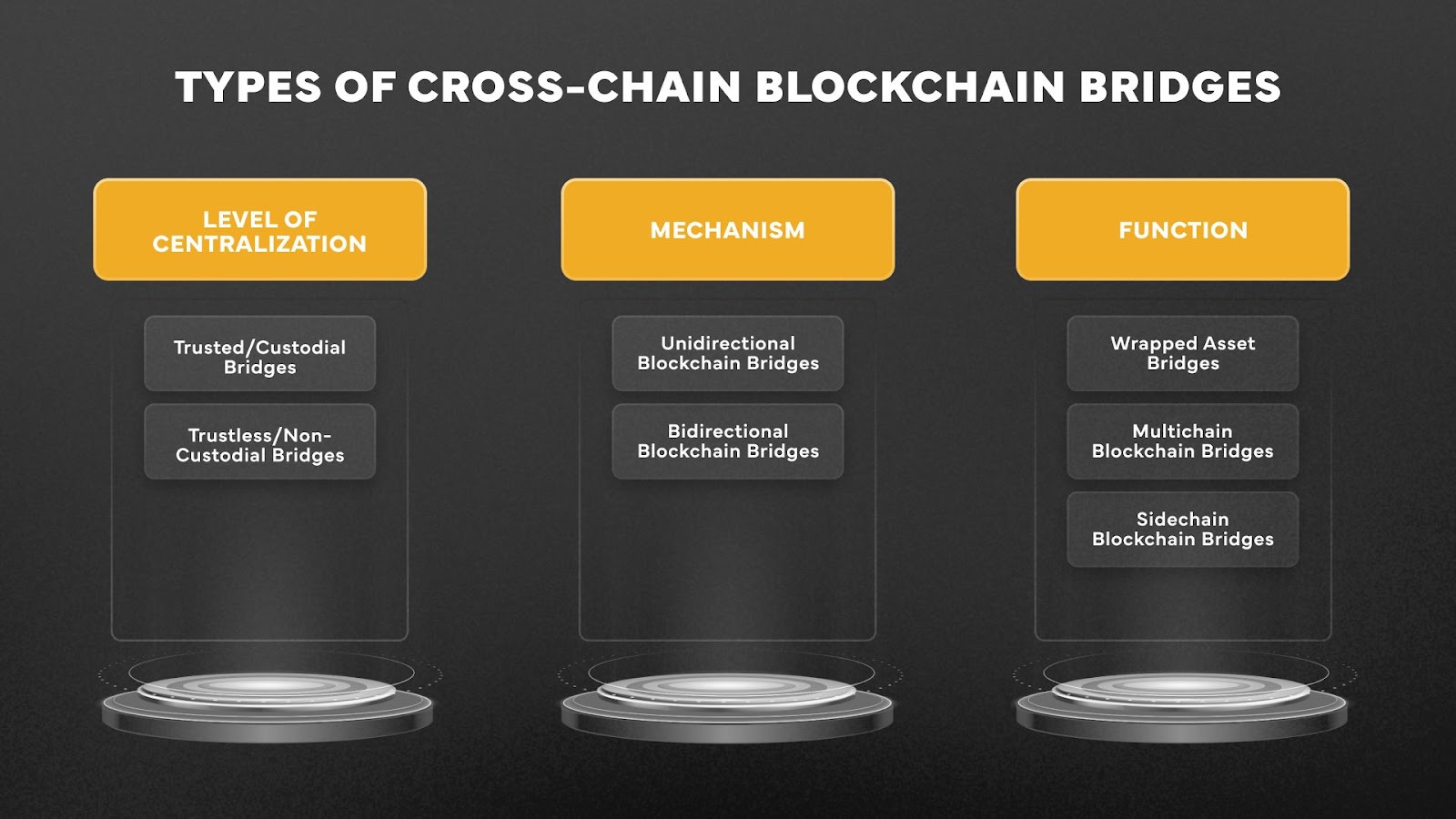

Blockchain bridges can be categorized by function, level of centralization, and mechanism. Let’s take a look at the different types of bridges in the market.

Cross-chain bridges can be organized into two categories: trusted (centralized) bridges and trustless (decentralized) bridges.

Trusted bridges are dependent on a central entity, named for the fact that users have to trust their funds with the central entity in charge. Users give up control of their assets to the bridge's owner and heavily rely on the entity's reputation.

Trustless bridges are decentralized protocols that leverage smart contracts to enable users to remain in control of their funds as they convert assets from one chain to another chain. There's no central entity in charge.

There are two main types of blockchain mechanisms: unidirectional (one-way bridges) and bidirectional (two-way bridges).

In one-way bridges, users can only transfer assets to another blockchain but not back to its native blockchain. The transfers are irreversible.

In two-way bridges, users can transfer assets back and forth between two networks, making it a preferred alternative for multiple transactions over unidirectional bridges.

Blockchain bridges can be categorized by functions into wrapped asset bridges, multichain bridges, and sidechain bridges.

Wrapped asset bridges “lock up” the user's assets and offer the user equivalent wrapped tokens compatible with the other network.

Multichain bridges facilitate the transfer of multiple tokens in a large number of networks. They are helpful when users are interacting with several wallets.

Sidechain bridges connect the parent network to the child network. They are necessary because the parent and child network may be using different consensus mechanisms. The bridge allows easy transfer between the first and second protocol layers.

Intrestingly, there are some new types of cross-chain bridges emerging. Examples are as follows.

Layer-2 scaling solutions, such as rollups, allow assets to move from the main chain to Layer-2 and back. They reduce transaction fees and increase throughput but require new types of bridges to connect these layers.

These bridges enable cross-chain communication for smart contracts. This opens up new possibilities for cross-chain dApps that can operate seamlessly across multiple blockchains.

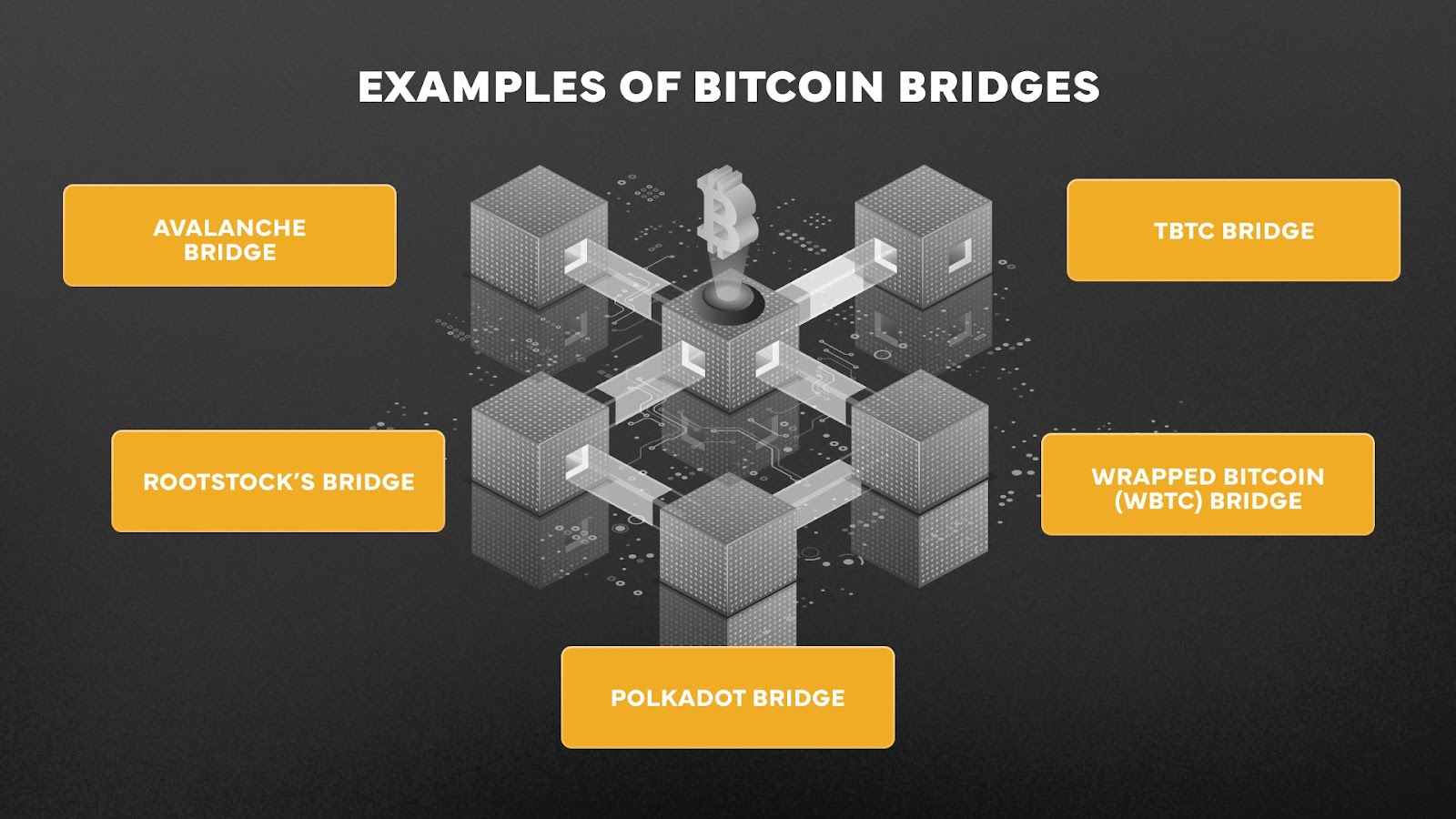

Here are a few bridges that connect Bitcoin with other chains.

Avalanche Bridge is a two-way cross-chain bridge that allows the transfer of BTC from the Bitcoin Network to Avalanche's C-chain. The protocol depends on Relayers that approve and reject data by comparing proposals to swap assets to Avalanche's data. BTC bridging is available through Core, a non-custodial browser extension on Avalanche.

Polkadot Bridge is a two-way bridge that is permissionless and financially trustless. The bridge connects the Bitcoin blockchain to the Polkadot network. It mints iBTC tokens that users can exchange for their BTC, unlocking BTC liquidity for Polkadot DeFi.

tBTC is Threshold's decentralized bridge that provides a trust-minimized platform for transferring BTC between Bitcoin and Ethereum. It’s a scalable and permissionless bridge that lets users exchange BTC for tBTC that can be used with Ethereum dApps.

PowPeg Protocol is the bridge powering the Rootstock sidechain by letting Bitcoin move to and from the chain. It is a two-way peg system that secures the locked BTC with the same Bitcoin hashrate that establishes consensus. It uses a model called defence-in-depth, where it utilizes several layers of relatively simple security protocols to ensure no vulnerabilities.

Wrapped Bitcoin (wBTC) Bridge enables Bitcoin to be used on the Ethereum network as an ERC-20 token called wBTC. It is backed 1:1 with Bitcoin and involves depositing BTC into a custodial vault, then minting the same amount of wBTC on the Ethereum blockchain.

Cross bridges offer several benefits for blockchain users, including flexible interoperability and increased functionality and scalability. However, the use of cross-chain bridges is not without risks.

Bitcoin bridges play an integral role in extending the reach of Bitcoin as a digital asset, allowing holders (or HODLers as they are known in the Bitcoin community) to use the world's leading cryptocurrency in other blockchain ecosystems.

Blockchain bridges provide several significant benefits, with the primary one being interoperability - the capacity for different blockchains to interact and communicate with each other. This interconnection allows for the seamless and secure transfer of tokens and data across multiple blockchain platforms, breaking down the barriers of isolated blockchain ecosystems.

They also promote diversity and competition in the cryptocurrency ecosystem by allowing users to leverage the strengths of various platforms.

By bridging gaps between blockchains, bridges help in enhancing liquidity, allowing wider access to various DeFi services and opportunities. Moreover, these bridges foster innovation by enabling cross-chain smart contract operations, thereby expanding the potential for decentralized applications.